how to calculate taxes taken out of paycheck in illinois

The state tax year is also 12 months but it differs from state to state. Employers are responsible for deducting a flat income tax rate of 495 for all employees.

Illinois Paycheck Calculator Smartasset

Some states follow the federal tax year some states start on July 01 and end on Jun 30.

. 505 on the first 44470 of taxable income. Calculates Federal FICA Medicare and withholding taxes for all 50 states. Change state Check Date General Gross Pay Gross Pay Method.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. 1216 on portion of taxable income over 150000 up-to 220000. The first step to calculating payroll in Illinois is applying the state tax rate to each employees earnings.

Choose Your Paycheck Tools from the Premier Resource for Businesses. Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck. Payroll So Easy You Can Set It Up Run It Yourself.

Supports hourly salary income and multiple pay frequencies. All Services Backed by Tax Guarantee. The Illinois Paycheck Calculator is designed to help you understand your financial situation and determine what you owe in taxes.

Get Your Quote Today with SurePayroll. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Calculate the sum of all assessed taxes including Social Security Medicare and federal and state withholding information found on a W-4.

The rate consists of two parts. Switch to hourly Salaried Employee. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest.

Salary Paycheck Calculator Illinois Paycheck Calculator Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. 915 on portion of taxable income over 44470 up-to 89482. This free easy to use payroll calculator will calculate your take home pay.

How much is 15 an hour after taxes. To use our Illinois Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. After a few seconds you will be provided with a full breakdown of the tax you are paying.

Similar to the tax year federal income tax rates are different from each state. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. How to calculate taxes taken out of a paycheck.

The Illinois paycheck calculator will calculate the amount of taxes taken out of your paycheck. Ad Compare 5 Best Payroll Services Find the Best Rates. Add any reimbursements or expenses incurred.

Make Your Payroll Effortless and Focus on What really Matters. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. The Illinois Paycheck Calculator uses Illinois tax tables and Federal Income Tax Rates for 2022.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. How much tax is deducted from a paycheck Canada. Yes if you are a resident of Illinois you are subject to personal income tax.

Employers are responsible for deducting a flat income tax rate of 495 for all employees. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Switch to Illinois hourly calculator.

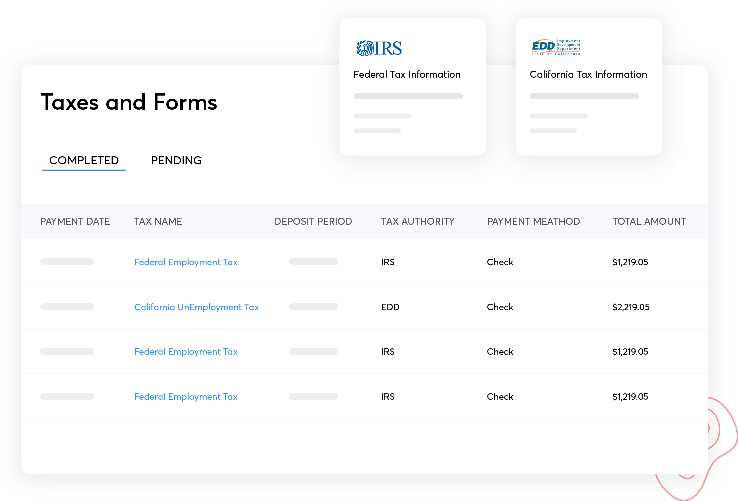

Illinois Resources Illinois calculators Illinois tax rates Illinois withholding forms More payroll resources Illinois Hourly Paycheck Calculator Gusto. According to the Illinois Department of Revenue all incomes are created equal. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs.

For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck calculator. State Date State Illinois.

Withholding is based upon the number of allowances an employee claims. When an employee doesnt provide an IL-W-4 youre required to withhold tax as if no allowances were claimed. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

The percentage thats withheld will depend on things such as your income your filing status single married filing jointly etc and any tax credits you indicate on your W-4 form. Paid by the hour. How do I calculate taxes from paycheck.

Taxable Income in Illinois is calculated by subtracting your tax deductions from your gross income. You can even use historical tax years to figure out your total salary. Incredibly a lot of people fail to allow for the income tax deductions when completing their annual tax return inIllinois the net effect for those individuals is a higher state income tax bill in Illinois and a higher Federal tax bill.

Ad Get Started Today with 1 Month Free. Youll use your employees IL-W-4 to calculate how much to withhold from their paycheck. Your employer will also withhold money from each of your paychecks to put toward your federal income taxes.

Ad Get the Paycheck Tools your competitors are already using - Start Now. In recent years there has been updates to the Form W-4. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Illinois.

1116 on portion of taxable income over 89482 up-to 150000. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Illinois Hourly Paycheck Calculator.

How To Calculate Payroll Taxes Methods Examples More

Online Payroll Software For Businesses Zoho Payroll

2022 Federal Payroll Tax Rates Abacus Payroll

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator Take Home Pay Calculator

How To Calculate Payroll Taxes Taxes And Percentages

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Paycheck Calculator Take Home Pay Calculator

How To Calculate Payroll Taxes Methods Examples More

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Payroll Tax What It Is How To Calculate It Bench Accounting

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

How To Calculate Payroll Taxes Taxes And Percentages

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Payroll Tax Calculator For Employers Gusto